Ultimate LandLord Guide 2023

There are many aspects to being a landlord beyond simply buying a property and ?nding a tenant. A whole range of responsibilities and issues will need consideration at the same time, and not doing so can create major legal and ?nancial problems.

Due to this it is important to understand some of the main problems which landlords may encounter unexpectedly and prepare for them ahead of time. In this guide we have gathered together the top concerns that landlords have and provided tried and tested strategies for overcoming them.

Property investment is not cheap, but the potential rewards are high if you get it right. More than a third of landlords are planning to purchase more properties in the next year according to Rightmove, and by reading this guide you can make the most of your investments and minimise your stress and time commitment at the same time.

![]() Falling rents and tenancy arrears

Falling rents and tenancy arrears

One of the main issues facing landlords in the UK is a tenant who fails to pay their rent on time. This is known as going into arrears and it can happen for any number of reasons, all of which can cause a problem for landlords. With the cost of living crisis squeezing people’s spending power, the potential for a tenant to go into arrears is increased, and therefore landlords should be aware and take action.

ARE RENTS FALLING?

This is the ?rst and most obvious worry for landlords due to the cost of living crisis, especially given that the UK’s rapid rental growth is one of the most attractive things about buy to let investment. If people have less money overall can they still afford higher rents?

The answer appears to be yes. Recent ?gures from Rightmove show that the average advertised rent outside London is 11.8% higher than it was this time last year. Certain cities such as Manchester are reporting an annual rise of 23.4%, while the capital London is also reporting 15.8% growth in a year.

Chatham in the London Commuter Belt was also a big winner for landlords, with average year-on-year rental growth of 21.4%

Places like this are seeing rent rises in spite of the cost of living crisis thanks to the imbalance between supply and demand.

Rightmove reports that the demand for rental properties is up by 26%, but supply has only increased by 6%. The luxury apartment market is especially busy at the moment as there are nowhere near enough units for all the tenants who want them leaving a good opportunity for landlords.

As will all aspects of property investment, doing your research and ?nding the right market is a valuable tool in ?nding the right investment. With a cost of living crisis ongoing, picking the right market is becoming essential, and areas like Manchester, Chatham and the wider London Commuter Belt are leading the way.

WHAT CAN YOU DO TO TRY AND PREVENT TENANTS GOING INTO ARREARS?

However, even if you buy in the busiest and most reliable markets, sometimes a tenant going into arrears is unavoidable. It can be incredibly frustrating when a tenant falls behind on rent, particularly if they do so repeatedly. Here are some strategies to minimise the chances of that happening:

1. Screen tenants properly

Doing the correct background checks on potential tenants before they sign the contract is a good way of limiting your potential liability. If they have a history of paying on time and have a salary which is more than enough to cover the rent, they are less likely to default.

2. Appropriate rent reviews

As a landlord you should carry out regular rent reviews to ensure you are charging a good amount of rent for the property. However, by ensuring that the rent is reasonable as well as pro?table you are more likely to ensure that the tenant can afford it and carry on paying on time.

3. Regular contact with the tenant

Having a good relationship with the tenant can ensure that you are aware ahead of time if there will be issues with rent payments. Likewise, if the tenant is in rent arrears you should make sure to chase them at regular intervals to give yourself the best chance of getting the rent paid.

4. Regular contact with the tenant

Having a good relationship with the tenant can ensure that you are aware ahead of time if there will be issues with rent payments. Likewise, if the tenant is in rent arrears you should make sure to chase them at regular intervals to give yourself the best chance of getting the rent paid.

5. Hire a lettings and property management agent

All of the above are viable strategies for minimising the chance your tenant goes into rent arrears. However, they are also time consuming and may become stressful if they take up too much of your life.

Tax implications of being a landlord.

Taxation is one of the hidden costs of being a landlord, and it is also one of the most signi?cant. It is an unavoidable part of property investment which is important to bear in mind from the start.

The best strategy for dealing with the tax implications of being a landlord is to understand them thoroughly. By doing so, you can make them part of your initial calculations and avoid unpleasant surprises in the future.

Below we have made a list of the different types of tax that you will pay as a property investor in the UK for your convenience. While they may appear to be a signi?cant cost up front, by investing in the best markets and in the right properties, you can achieve the maximum pro?tability and offset them.

For example, by investing off-plan in a market such as Manchester city centre, the additional Stamp Duty Land Tax cost you pay as an investor could be covered by as little as six months of rental yield.

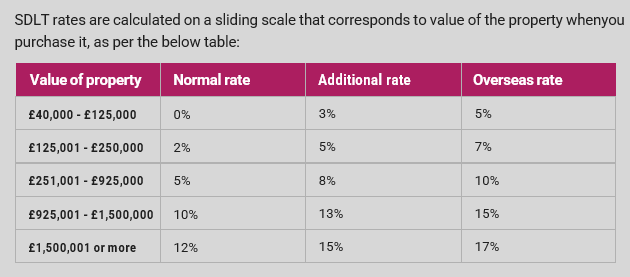

Stamp Duty (SDLT)

Stamp Duty Land Tax (SDLT) is a tax applied to all residential property purchases in England and Northern Ireland worth more than £125,000. In addition to this, a 3% surcharge is payable by all investors purchasing a property in England or Northern Ireland, and an additional 2% levy is payable by overseas investors doing the same thing.

The full Stamp Duty amount must be paid within 30 days of completing your purchase and a ?ne may be payable if you do not do so in this time period. Your ?nancial advisor will be able to con?rm the exact amount payable before you purchase.

Income Tax

Income tax must be paid on all of your income in the UK on a sliding scale from a basic 20% to a maximum of 45%. This will be the case for your monthly rental income, one of the two income streams you bene?t from as a landlord.

A good accountant will work out the exact amount on your behalf, reducing your workload and making sure that that investment process is as easy as possible.

Capital Gains Tax (CGT)

If you choose to sell your property, you must pay a different type of tax on those pro?ts. Capital Gains Tax (CGT) is levied as a percentage of the pro?t made over the original purchase price – the ‘capital gain’ which gives the tax its name

It is charged to all sellers making a pro?t, including overseas owners, and the rate differs based on whether you are an individual (either 18% or 28% depending on the capital gain made by the sale), working through a trust (28% for trustees) or a company (20%).

As with rental income and Income Tax, your accountant will take care of this process on your behalf and make sure that the right amount of tax is paid in the required time frame.

Inheritance Tax

Inheritance Tax is a tax paid on the estate of someone who has passed away. The includes on the value of any property passed on. The only circumstanceswhere it does not apply are

- The value of your estate is below £325,000, OR

- Everything over £325,000 is left to your spouse, civil partner, a charity or a community amateur sports club

If neither of those criteria apply, your estate will be taxed at 40% on anything above the £325,000 threshold whe you die, This threshold becomes 36% if you leave at least 10% of the value to a charity after any other deductions in your will.

However, Inheritance Tax can be tricky and comes with other exceptions in speci?c circumstances. For example, the Residence Nil-Rate Band potentially allows you to pass on an additional £175,000 tax-free to your direct descendants on top of the £325,000 allowance, meaning you could pass a property worth £500,000 tax free to your children or grandchildren.

In this area of tax speci?cally, so much depends on your individual circumstances that we highly recommend you talk to an independent ?nancial advisor to determine your responsibilities.

Council Tax

Council Tax is payable by the tenant of the property, however if there is a void period you will need to cover it until a new tenant moves in. This cost will be approximately £80-£120 a month, depending on where the property is located.

The relevant local Council will be able to advise on the exact amount you will owe for Council Tax each month if your property is lying empty.

Landlord regulation

There is a lot of legislation for landlords to be aware of and navigate as you let your property to a tenant. There are at least 150 separate bits of legislation that apply, and there are new ones being brought in or considered all the time.

Breaking the law as a landlord can lead to ?nes and more severe punishments. As per the English Private Landlords Survey 2021: “Since 2010, there have also been a number of policy changes affecting private landlords. These include tax changes for Buy-to-Let landlords, changes to the Stamp Duty Land Tax, tightening lending criteria on Buy-to-Let mortgages and the growing role of the Build to Rent sector.

More recently, the government has announced plans to reform the private rented sector, including the removal of ‘no fault’ evictions under Section 21 of the Housing and Planning Act.”

Additionally, there are separate rules around ?re safety which are extremely important to make sure you understand and get right. They are as follows, with links explaining further:

- Fit and test smoke alarms and carbon monoxide alarms

- Follow ?re safety regulations for property in a purpose-built block of flats or for houses and property adapted into flats

Finally, the major news for landlords moving forward is the Renters Reform Bill which will remove ‘no fault’ Section 21 evictions to “provide greater security for tenants while retaining the important flexibility that privately rented accommodation offers”. Landlords will no longer be able to evict tenants for no reason.

Instead, the Renters Reform Bill will abolish Section 21 evictions and simplify tenancy structures by moving all Assured Tenancies or Assured Shorthold Tenancies onto a single system of periodic tenancies.

Under this new bill, a renter would have to provide two months’ notice when leaving a tenancy to allow landlords adequate time to ?nd a new tenant and hopefully avoid a damaging void period. Tenants can still be evicted in “reasonable circumstances” as de?ned by the law, but these will be much more limited than they currently are.

In addition to the basic national laws stated above, there are various powers that Councils have on a local level which landlords should be aware of.

The Housing Health and Safety Rating System (HHSRS) is used by your council to make sure that properties in its area are safe for the people who live there. This involves inspecting your property for possible hazards, such as unsafe structural aspects or a mould problem.

It can be overwhelming for even the most experienced landlords, and that is why the best way to make sure you are on top of landlord legislation is to appoint a professional letting and management agent.

They ensure that your property meets all requirements and that all safety measures are up to date, as well as keeping you informed of any relevant legal changes which affect your investment. For the price of a small percentage of the monthly rental income, you will not have to worry about any of it.

![]() Cost of Finance.

Cost of Finance.

Financing a buy to let property is largely similar to ?nancing a property as a homebuyer, but there are some differences. You should be aware of these before starting, and should also take into consideration how the latest economic news may affect ?nancing options in the UK.

The easiest way to purchase a buy to let property is to buy in cash. If you do so, you will own the property outright straight away and all monthly rental income will be pro?t for you rather than go towards paying off a mortgage. Similarly, you will be able to bene?t fully from capital appreciation once you sell the property.

However, using a special buy to let mortgage also has its bene?ts. They are available to domestic and overseas buyers, and using them can help you spread your capital around more widely. This gives you the potential to build a larger portfolio in a shorter timeframe.

As with a homeowner mortgage, your eligibility will vary depending on your personal circumstances Consult with your ?nancial advisor and mortgage broker to get information that is right for your individual circumstances.

Advising, arranging, lending and administering BTL mortgages for consumers is covered under the same laws as residential mortgages and is regulated by the Finance Conduct Authority (FCA)

Buy to let mortgages tend to operate in a similar way to homebuyer mortgages, but there are some key differences:

The fees can be much higher

- Interest rates on buy-to-let mortgages are usually higher, which has implications in the current climate – please read on below for more information

- The minimum deposit for a buy-to-let mortgage is usually 25% of the property’s value, and can be as much as 40%

- Most products are interest-only which means you pay the interest each month, but not the capital amount until the end of the term, when you will pay it in full. Repayment buy to let mortgages are also available

- Affordability is judged based on the projected monthly rental income of the property rather than your personal monthly income

Cost of mortgages going up

A major consideration for investors looking to ?nance their property purchases via a mortgage is the increasing rate of interest. As the cost of living crisis continues to unfold in the UK, the Bank of England has responded by raising interest rates – most recently by a further 0.5%, for a total of 1.75% as of August 2022.

Put simply, if interest rates are higher, you will pay more to borrow via a mortgage. This is especially the case with buy to let mortgages which are mainly interest-only. Landlords looking at their next property purchase should be aware of this and factor it into any affordability calculations. Make sure to consult with your ?nancial advisor and mortgage broker before buying to fully understand the ?nancial implications of higher interest rates on your preferred mortgage.

Another factor to bear in mind is that buy to let mortgages are based on Predicted rental income, as mentioned previously. This means that your application may be refused if the bank is not con?dent that your property will be tenanted consistently, or at a high enough rent.

The most practical solution to the above issues is to choose your investment market carefully. The higher rates of interest, and the costs they create for mortgages, can be combatted by focussing on markets where rents are rising and projected to continue doing so far into the future. For example, Manchester and the London Commuter Belt are both hugely popular areas where demand is far ahead of supply because people are moving there in large numbers and the economy is growing fast.

Rents and property prices are growing in these areas faster than any costs you will have to deal with, and so they offer mitigation for the rising price of mortgages – allowing you to invest and stay pro?table even in this tougher time. Such markets also offer a higher likelihood of consistent tenancy thanks to the overwhelming demand. This will help the banks to have con?dence in your purchase and approve your mortgage application.

The rising cost of ?nancing your buy to let property investment is a valid concern and something that you should take seriously as you do your research. However, there are ways around it for savvy investors who understand the market and pick the right places to invest.

EPC requirements.

An Energy Performance Certi?cate (EPC) must be provided as part of every property purchase in the UK according to the law. It measures the energy ef?ciency of a property on a scale of A-G and gives detailed information about its sustainability and carbon emissions.

In April 2018, new Minimum Energy Ef?ciency Standards (MEES) were introduced which made it a legal requirement for all privately owned properties to have an EPC rating of at least an ‘E’ before they are sold or let. This legislation applies to both domestic and commercial properties, although’there are some exceptions around properties which are Listed and therefore may not be suitable for energy ef?ciency works.

However, it applies to 98% of residential properties in the UK and as a landlord you should assume that you will need to achieve an EPC rating of at least E. Those who fail to meet this standard could be charged up to £5,000 for each residential property.

In future, these regulations are set to become stricter as the need to increase the sustainability of the built environment becomes more urgent. New government legislation means that all residential properties which are rented out will need to achieve an EPC rating of C or above by 2025. If they do not do so, they are not eligible for rent.

Similarly to previous legislation, this will ?rst be applied to all new tenancies by the initial 2025 date and then be expanded to all tenancies including existing ones by 2028.

The ?nal thing to note is that the penalty for not having a valid EPC will increase from £5,000 to £30,000 from 2025.

New builds more attractive for investors

Over the past decade, energy ef?ciency measures have improved signi?cantly in all areas and are now being incorporated as standard into new properties. Improved insulation, more ef?cient boilers, electric panel heaters, decentralised energy and more sustainable building materials are just a few of the sustainability features that new build homes typically include in 2022.

Due to this, new build properties will tend to have a much higher EPC rating than existing properties. Approximately 94% of new builds are rated at band C or above, and therefore they are cheaper to run and more attractive to tenants. Additionally, they will retain their value and be future-proof in this way against further legislation changes for many years to come.

Cladding

One of the most pressing questions facing buy to let landlords in the UK concerns cladding. This is the biggest story in the industry and it is attracting a lot of attention as many people – including landlords – are beginning to face mounting bills and increased uncertainty due to a problem they did not cause.

The Grenfell Fire disaster made it clear that not only is a lot of existing cladding ineffective, but it is also flammable and often dangerous to life. This has led to a rush to replace flammable cladding on high rise and other buildings before another tragedy occurs.

In practical terms, this means that expensive retrospective work is being carried out on buildings across the country and there has been a huge row over who is paying for it, with developers trying to make leaseholders pay to ?x a problem they did not cause.

The government has brought in the Building Safety Act 2022 to protect leaseholders in law for the ?rst time and prevent the costs of replacing unsafe cladding being payable by them. Instead, the Secretary of State at the time the law was written, Michael Gove, has shifted the burden onto the developers and freeholders of buildings up to 11m in height. The bill also opens up a new phase of the Building Safety Fund (BSF) – a £5.1bn pot for the next 10 years to fund the removal of dangerous, flammable cladding from buildings.

Landlords were initially excluded from the list of leaseholders who could apply to the Building Safety Fund, however this was amended to say that landlords who owned two or fewer properties would bene?t from a cap on how much they could be asked to pay.

This still leaves portfolio landlords with huge potential costs and it is the unfortunate truth that these people will face mounting costs as they have to replace cladding under the new laws.

How can landlords bene?t?

The process of working out how the cladding scandal in UK property will be solved is still ongoing. In the meantime, there are some types of landlords who will bene?t, and a strategy to take for your next investment that will help limit your exposure.

The ?rst group that could bene?t are smaller or new landlords who will only have two or fewer properties in the same building. Cladding relief will be available to these landlords in the form of a cap on the cost of cladding work – £10,000, or £15,000 in London. This will help smaller landlords keep costs down and incentivise new landlords to keep investing in a limited number of properties.

The second group are those landlords who purchase new build properties. New developments will have to meet the new, higher standards of cladding in order to complete and will therefore not come with any concerns about flammable cladding.

How can landlords bene?t?

The process of working out how the cladding scandal in UK property will be solved is still ongoing. In the meantime, there are some types of landlords who will bene?t, and a strategy to take for your next investment that will help limit your exposure.

The ?rst group that could bene?t are smaller or new landlords who will only have two or fewer properties in the same building. Cladding relief will be available to these landlords in the form of a cap on the cost of cladding work – £10,000, or £15,000 in London. This will help smaller landlords keep costs down and incentivise new landlords to keep investing in a limited number of properties.

The second group are those landlords who purchase new build properties. New developments will have to meet the new, higher standards of cladding in order to complete and will therefore not come with any concerns about flammable cladding.

Ground rent abolition.

Investing in UK property comes with a range of additional costs, the most contentious of which in recent years has been ground rent.

Currently, if you own a long lease on a property in the UK – as is often the case when buying a new property under a leasehold – you will normally have to pay an annual fee to the owner of the freehold. This is known as ground rent, and the amount will vary depending on the terms of the leasehold you have purchased.

Ground rent rates can be ?xed or they can escalate, and the latter scenario created a situation where buyers were trapped in leaseholds where the cost was doubling every ?ve or 10 years as part of the purchase agreement.

Ground rents are a cost that does not provide a service, making them unjusti?able, and so these charges have been banned on most new leases purchased as of 30 th June 2022.

The Leasehold Reform (Ground Rent) Bill 2022 restricts ground rents on long leases of flats and houses to a token peppercorn rent each year – to all intents and purposes, the value of this newground rent is zero.

How does this bene?t landlords?

The removal of ground rents on new leases should automatically move new-build properties to the top of your list due to the inherent bene?ts you will receive. Crucially, it is important to note that the legislation will not apply retrospectively to existing properties with leases that are already signed and in effect.

In effect, this creates a two tier market. One the one hand you will have new properties with effectively zero ground rent costs, and on the other you will have existing properties which will continue to have ground rents which could cost you hundreds or even thousands of pounds a year.

Furthermore, selling an existing property which does require these payments will only become more dif?cult. By purchasing an existing property you potentially pay more during your ownership period thanks to ground rent, and you are also more likely to lose out when you come to sell it.

The abolition of ground rents on new-build properties is good for investors overall, and acts as yet another incentive to buy a new property.

Cost of living crisis

Britain is facing a cost of living crisis thanks to high inflation and rising energy prices squeezing the spending power of millions of households up and down the country.

This situation has left many wondering about the state of the overall economy and whether its reliability should be called into question. One area that is proving to be resilient in the face of the cost of living crisis is the UK property market, and perhaps here we can see that there is some potentially good news for many people.

The latest ?gures from the Nationwide house price index show that annual house price growth actually increased in August to 11%, from 10.5% in July. Prices rose by 2.1% in total month-on- month when seasonal changes are taken into account, and overall prices are now 13% higher than they were in 2019 before the COVID-19 pandemic began.

Lack of supply the key factor

The outlook for the property market is still cloudy, though the housing market’s fundamentals remain strong. Underlying demand is likely to stay strong in the near future as the basic principles of supply and demand remain in place. There are nowhere near enough homes being built to meet demand and that won’t change in the foreseeable future. Due to this, prices in the housing market are likely to retain stability and growth prospects.

Likewise, employment rates are at their highest in decades (over 75%) according to ?gures released recently by the Of?ce for National Statistics, and that has given more people the kind of certainty that is needed to contemplate a new property move or purchase leading to a stronger market.

While there is a danger that spending power will decrease, and that this will have an impact on the affordability of new mortgages, experts believe that a potential slowdown is far from assured.

Indeed, the past behaviour of the housing market and people buying property in the UK suggests that fears could be overblown. Thea fore mentioned factors which are serving to increase the value of property in the UK especially the lack of supply and the accompanying low rates of new construction are long-term factors which are not going to be resolved. This should give con?dence in the housing market through any possible tough times in the short-term.

While nothing in life is ever completely certain, the property market’s reliability is more certain than most, and that remains the case even in the face of a cost of living crisis